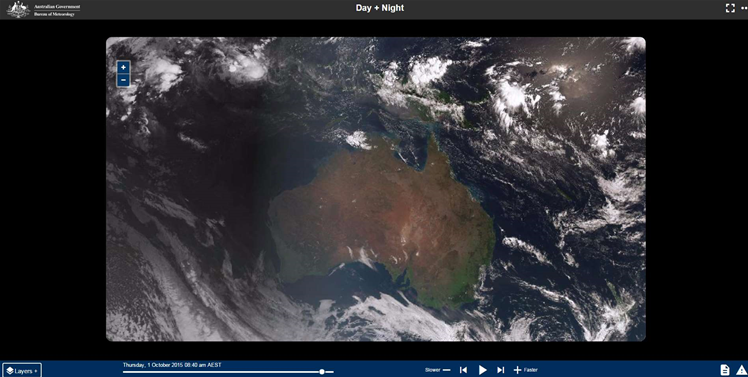

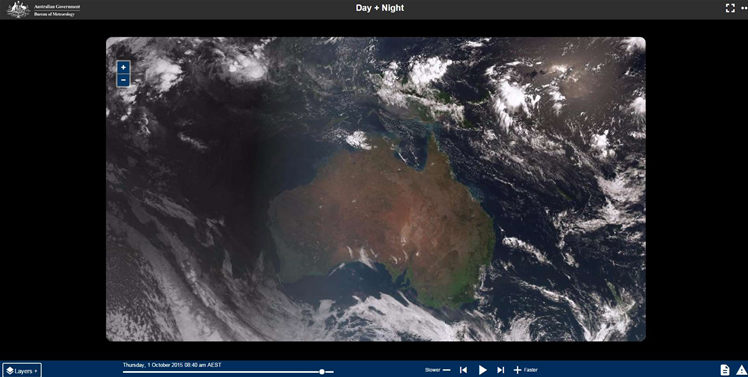

BoM’s Website Revamp: A Pricey Endeavor

The Bureau of Meteorology (BoM) recently wrapped up a hefty $96 million revamping of its online platforms. Even with this expenditure, the bureau still relies on its legacy website, reg.bom.gov.au, which will continue to operate indefinitely, particularly for emergency services and industry clients dependent on its essential data.

Political Context and Budget Surplus

Minister for Environment Murray Watt voiced concerns over BoM’s transition strategy. What was intended to be a unification and replacement of the current platforms has turned into a mere addition to the legacy site. The project’s financial plan surged from an initial $31 million pact with Accenture to $96.5 million, intensifying political scrutiny.

Functionality and User Interaction

A spokesperson for BoM indicated that the new site is designed to elevate the user experience for the general audience. Nevertheless, it does not supplant the fundamental functions of the legacy platform, which remains vital for supplying specialized data access to emergency services.

Conclusion

The Bureau of Meteorology’s expensive website enhancement has not removed the necessity for its legacy platform. While the new site intends to serve general users, the legacy site remains critical for essential data access. The venture has encountered budget overflow and political backlash, underscoring the complexities of digital evolution in public services.

Q: Why does BoM continue to depend on its legacy platform?

A: The legacy platform offers vital weather data to emergency services and industry sectors that need it, and its continued operation was always intended.

Q: What was the original budget for the BoM website revamp?

A: The original budget was $31 million, as per the agreement with Accenture, but it ultimately rose to $96.5 million.

Q: What enhancements does the new BoM website provide?

A: The new website aims to boost user experience for regular consumers with revamped pages and an upgraded interface.

Q: Has BoM established a timeline for phasing out the legacy platform?

A: No, there is not currently a timeline set for phasing out the legacy platform, and it will continue to function indefinitely.

Q: What are the primary elements of the BoM website revamp budget?

A: The budget encompasses $4.1 million for frontend redesign, $79.8 million for primary channel platform deployment, and $12.6 million for security and testing.

Q: How has BoM enhanced security in the new website?

A: The BoM has concentrated on mastering TLS website security as part of the new site’s creation, ensuring it is both secure and stable.