Cybersecurity Agreements Fall Short of Boardroom Demands, Cautions Kaine Mathrick Tech CEO

We independently review everything we recommend. When you buy through our links, we may earn a commission which is paid directly to our Australia-based writers, editors, and support staff. Thank you for your support!

Quick Read

- Cybersecurity agreements are misaligned with the requirements of boardrooms, claims Kaine Mathrick Tech CEO.

- The Cyber Security Act 2024 alongside new ransomware disclosure mandates underscores the requirement for revised incident response agreements.

- Organizations ought to integrate cyber resilience into procurement and vendor governance procedures.

- Board members are advised to prioritize risk, resilience, and governance over purely technical measures.

The Expanding Discrepancy in Cybersecurity Agreements

Cybersecurity agreements are inadequately meeting the extensive demands of boardrooms, as stated by Bradley Kaine, CEO of Kaine Mathrick Tech. With the evolution of cyber threats, there is a growing need for contracts that focus on extensive risk management and governance, rather than limiting themselves to technical solutions.

Regulatory Drivers: Cyber Security Act 2024

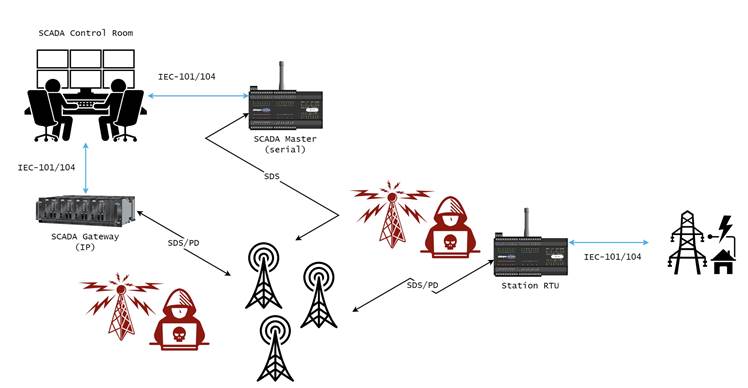

The Cyber Security Act 2024 and the obligation for 72-hour ransomware payment reporting are critical prompts for organizations to reassess their incident response strategies. However, Kaine cautions against considering these regulations as simply compliance tasks. They should encourage a more profound incorporation of cyber resilience into the overall organizational strategy.

Integrating Cyber Resilience

Bradley Kaine highlights the necessity of integrating cyber resilience throughout all levels of procurement and vendor management. This entails conducting risk-focused evaluations of suppliers, ensuring contracts stipulate clear expectations regarding incident response, and thoroughly examining cyber insurance policies.

Strategic Synchronization with Boardroom Requirements

Even with the increasing number of cyber threats, numerous cybersecurity agreements still prioritize IT concerns while failing to align with the strategic requirements of boardrooms. There is an urgent need for contracts to incorporate the lexicon of risk, resilience, and governance. Kaine recommends the implementation of board-level provisions that feature regular updates, adherence to defined frameworks, and clauses for third-party assessments.

Conclusion

As they confront evolving cyber threats and heightened regulatory scrutiny, Australian organizations must adjust their cybersecurity agreements to better fit boardroom requirements. This transition involves moving from solely technical responses to a focus on risk management and strategic alignment. Integrating cyber resilience into procurement strategies and ensuring thorough incident response initiatives are essential measures for this alignment.

Q&A

Q: What is the primary concern with existing cybersecurity agreements?

A: Existing cybersecurity agreements typically do not meet the strategic expectations of boardrooms, leaning heavily on technical details instead of encompassing broader risk management and governance elements.

Q: In what way should organizations adjust to the Cyber Security Act 2024?

A: Organizations should regard the Act as a prompt to review and improve their incident response protocols, ensuring the incorporation of cyber resilience in their procurement and vendor management activities.

Q: What is an essential clause in contracts pertaining to incident response?

A: A “Compulsory Incident Notification and Collaboration” clause is vital, mandating that vendors immediately inform clients about ransomware occurrences and fully cooperate in investigations and subsequent reporting.

Q: How can boards guarantee that cybersecurity agreements fulfill their requirements?

A: Boards should require clauses that mandate regular updates on cybersecurity status at the board level, alignment with accepted frameworks, as well as provisions for third-party evaluations and incident drills.

.jpg&h=420&w=748&c=0&s=0)