Superloop’s Strategic Growth Via Lynham Acquisition

Brief Overview

- Superloop set to acquire Lynham Networks for $165 million.

- Acquisition will enhance Superloop’s national FTTP capabilities.

- Strategic emphasis on high-density and greenfield projects.

- Projected annual cost savings of $5 million.

- Superloop plans to broaden its built and contracted FTTP footprint.

- Superloop reports impressive financial growth and raised earnings forecast.

Superloop’s Strategic Initiative in the Broadband Market

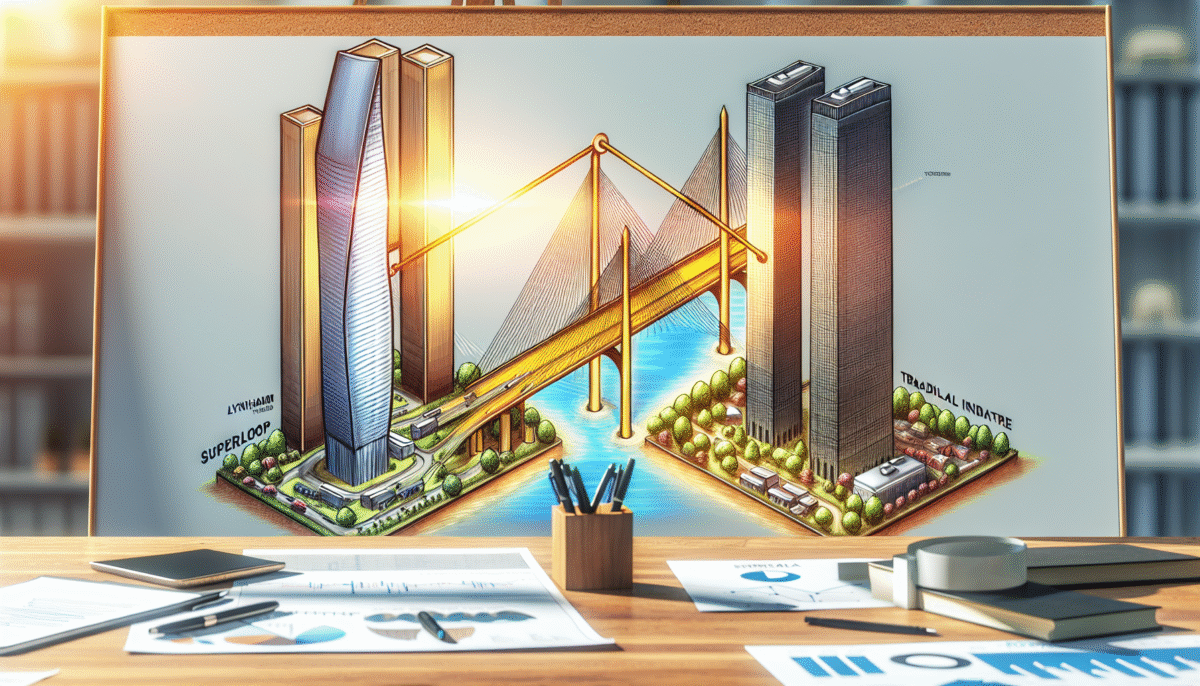

Superloop has announced intentions to purchase the rival fibre-to-the-premise (FTTP) network wholesaler, Lightning Broadband, in a notable $165 million transaction. This strategic move is set to enhance Superloop’s capabilities as a major national FTTP player, particularly against competitors like NBN Co.

Enhancing Network Infrastructure and Competitive Edge

The acquisition, which awaits necessary approvals, enables Superloop to gain full ownership of Lynham Networks, thus increasing its built and contracted FTTP reach to 170,000 lots. Paul Tyler, Superloop’s CEO, indicated that this action will fortify the company’s standing as a powerful network infrastructure developer.

This will expedite Superloop’s “smart communities” initiative, concentrating on high-margin broadband solutions in densely populated and greenfield locations, where competition with NBN Co is strong.

Expansion and Financial Performance

Lynham Networks, operating 14,000 active wholesale services, reported revenues of $46.7 million, a 28 percent rise from the previous half-year. The acquisition incorporates 24,000 built lots and contracts for an additional 30,000 lots anticipated over five years, with a transition targeted for completion in the fourth quarter.

Superloop has announced a robust half-year financial performance with a net profit after tax of $5.1 million on group revenue of $317.6 million. The company’s revised full-year earnings outlook anticipates revenue of $700 million and an EBITDA ranging from $112 million to $120 million.

Integration Plans and Cost Efficiency

Superloop predicts achieving annual cost savings of $5 million by assimilating Lynham’s operations within its current networks. The acquisition will also result in the merging of Lynham’s staff into Superloop, with about 70 employees expected to join post-acquisition.

This strategic initiative positions Superloop to capitalize on its international transit and overseas network infrastructure, improving its market position with developers and retail service providers.

Conclusion

The acquisition of Lynham Networks by Superloop signifies a pivotal advancement in cementing its role as a top FTTP provider in Australia. With an emphasis on smart community strategies and resource integration, Superloop is poised to enlarge its presence and financial standing in the national broadband sector.

Q&A: Clarifying the Superloop Acquisition

Q: What is the worth of the acquisition deal?

A: The acquisition is valued at $165 million.

Q: How will this acquisition influence Superloop’s market position?

A: The deal will strengthen Superloop’s status as a national FTTP contender, improving its market credibility and infrastructural resources.

Q: What are the anticipated cost reductions from the acquisition?

A: Superloop aims to realize annual cost savings of $5 million within the first three years by merging networks and optimizing operations.

Q: How will this acquisition affect Superloop’s clientele?

A: The acquisition will broaden Superloop’s customer base, incorporating a combination of built and contracted lots, aiding the company’s growth plan.

Q: What recent financial performance has Superloop disclosed?

A: Superloop reported a net profit after tax of $5.1 million with group revenue of $317.6 million for the half-year, revising its full-year earnings forecast.

Q: Will Lynham employees face changes due to the acquisition?

A: Superloop anticipates incorporating around 70 Lynham employees once the acquisition is finalized.