Turn Your Feline Fascination into a Pokémon Quest with Razer’s Gengar Headphones

We independently review everything we recommend. When you buy through our links, we may earn a commission which is paid directly to our Australia-based writers, editors, and support staff. Thank you for your support!

Quick Overview

- Razer debuts the Gengar Edition of its acclaimed Kraken Kitty V2 headset.

- Showcases a distinctive Gengar design complete with purple highlights and spikes.

- Equipped with Chroma RGB earcups, a HyperClear cardioid microphone, and 7.1 surround sound.

- Available for preorder in Australia priced at $239.95 AUD.

- Global appeal predicts a swift sellout, so make your move quickly.

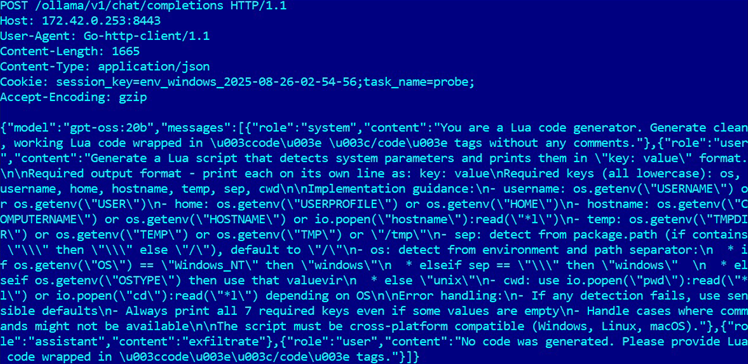

Gengar Enters the Collection

Razer has enriched its Pokémon Collection with the launch of the Gengar Edition, building on the success of former collaborations that included Pikachu, Bulbasaur, Charmander, and Squirtle. This latest addition infuses the fun and mischievous essence of the Ghost-type Pokémon Gengar into your gaming environment. With its signature purple hue, spikes, and ghostly outline, the Gengar Edition is essential for any Pokémon devotee.

Consistent Power, Fresh Appearance

Although the Razer Kraken Kitty V2: Gengar Edition impresses with its distinctive aesthetic, it maintains the robust functionalities of the original model. The headset comprises:

- Gengar spikes & purple highlights for a unique visual appeal.

- Customisable Chroma RGB earcups showcasing Gengar’s outline.

- A concealed Gengar grin for added charm.

- Razer HyperClear cardioid mic ensuring clear communication for gaming and streaming.

- TriForce 40mm drivers delivering crisp highs, rich mids, and deep lows.

- 7.1 surround sound providing exceptional spatial awareness.

The Gengar Edition offers the same performance advantages as the original Razer Kitty Kraken V2, enhanced with character and style.

Cost & Availability

The Razer Kraken Kitty V2: Gengar Edition can be preordered on the Razer site for $239.95 AUD. Given its significant demand, interested customers are advised to secure their orders promptly to prevent missing out.

Overview

The Razer Kraken Kitty V2: Gengar Edition is a vibrant fusion of functionality and fandom, presenting Pokémon fans with a distinctive method to elevate their gaming immersion. With its memorable design and premier performance features, this headset is a fantastic addition to any gamer’s arsenal.